Back to Normal? : What Ending Federal Unemployment Benefits Could Mean For Business

“We hoped to extend staff over the summer but finding people who want to work has been difficult.” Joey Richards, manager of True Value Hardware, expressed his frustration. “The other manager and I are working constantly just to cover shifts. Something needs to change,” Richards continued.

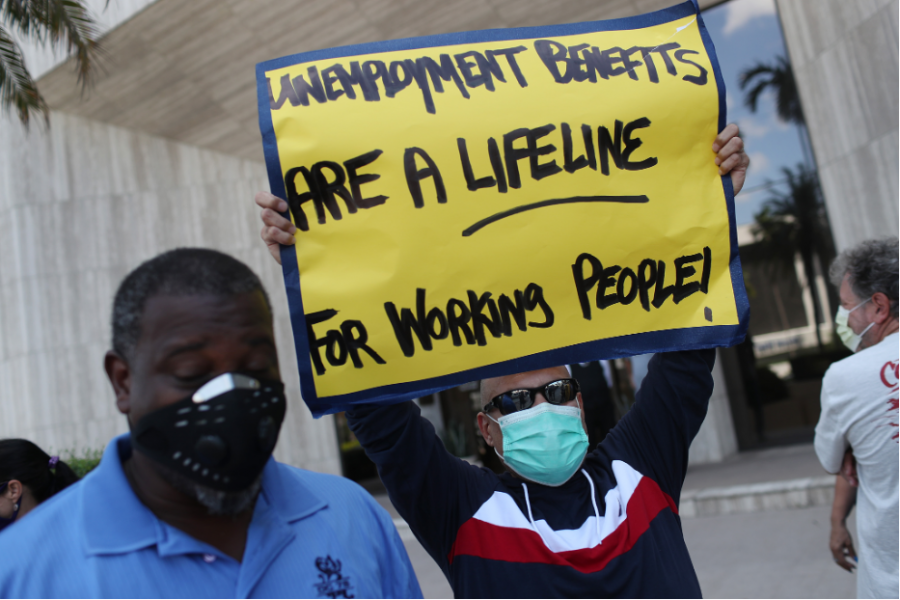

The pandemic changed the economic landscape before our own eyes. Government-mandated lockdowns sent business owners and laid-off individuals scrambling for assistance. In heed of sky-high unemployment, the federal government passed measures to combat a long-term recession. Several businesses received relief through packages like the Payment Protection Program (PPP). Those laid-off hit the unemployment line. Relief packages, such as Federal Pandemic Unemployment Compensation (FPUC), have provided an additional $600 per week for individuals receiving regular unemployment benefits.

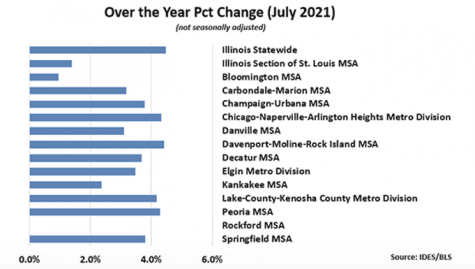

In July 2020, the unemployment rate in Springfield was 12.3%. Just a year later, that number hit a low of 6.1%. Matthew Brown, UIS Professor of Economics, said, “while we are generally not surprised to see unemployment numbers rise quickly at the beginning of a severe negative economic shock, like the current pandemic, they generally do not move in the opposite direction as quickly.” Unemployment numbers are still up in the area from October 2019, when the city reached a rate of just 3.5%.

In July 2020, the unemployment rate in Springfield was 12.3%. Just a year later, that number hit a low of 6.1%. Matthew Brown, UIS Professor of Economics, said, “while we are generally not surprised to see unemployment numbers rise quickly at the beginning of a severe negative economic shock, like the current pandemic, they generally do not move in the opposite direction as quickly.” Unemployment numbers are still up in the area from October 2019, when the city reached a rate of just 3.5%.

On Sept. 4, Illinois stopped offering federal unemployment benefits. These programs include: Pandemic Unemployment Assistance (PUA), Federal Pandemic Unemployment Assistance (FPUA), Pandemic Emergency Unemployment Compensation (PEUC), and Mixed Earners Unemployment Compensation (MEUC). Many business owners and managers indicate they are ready for these programs to come to an end.

“At first, we had a pretty hard time getting anyone to apply,” Elizabeth Giacometti, front desk manager at the Wyndham Springfield City Centre, said. “Now we have a hard time even getting people to show up for interviews.” Giacometti went on to indicate that she hopes ending federal unemployment benefits will encourage people to get back to work.

Professor Brown is not as optimistic. “I do not expect unemployment numbers to drop quickly. Unemployment insurance is one important component of people’s decision making when deciding to seek employment or accept job offers; but a number of other factors like long-term behavioral patterns that may have developed during lengthy periods of unemployment, concerns about safety in certain jobs during the pandemic, family and spousal income, and the types of jobs available also play important roles in those decisions,” he concluded.

Following nearly one year of remote schooling, UIS’s situation plays like a broken record. “Like other employers across the country, UIS has experienced some challenges filling certain vacant positions for employees at the university. The number of applications appears to be down in general compared to pre-pandemic times,” said Associate Vice Chancellor for Human Resources, Melissa Mlynski.

There is some good news for employers experiencing labor shortages. Unemployment numbers are expected to decline in the coming months. The Bureau of Labor Statistics says that they believe by 2022, U.S. unemployment will wane to 5.4%. A study from the Federal Reserve predicts that figure falling under 4% in the coming year. Be that as it may, what do these numbers mean to those on unemployment?

As the saying goes, “work smarter, not harder.” In many cases, those collecting unemployment benefits have seen a lower opportunity cost than if they were to return to the workplace. In response to the pandemic, stimulus packages and increased unemployment benefits have generated stronger arguments for higher wages, benefits and otherwise. That said, wages are increasing marginally. Whether this signals a long-term retooling of worker-employer relations, it is much too soon to tell. Nevertheless, it is apparent that businesses are making an effort to get people back to work.